|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Why Would You Refinance Your House: Key Benefits and ConsiderationsRefinancing your home can be a strategic financial decision for many homeowners. This process involves obtaining a new mortgage to replace the existing one, often with better terms. Understanding why you might choose to refinance is crucial for making informed decisions. Benefits of Refinancing Your HomeLower Interest RatesOne of the primary reasons homeowners refinance is to take advantage of lower interest rates. A reduced rate can significantly decrease your monthly payments and the total interest paid over the life of the loan. Changing Loan TermsRefinancing allows you to adjust the length of your mortgage. You might shorten your term to pay off your home faster or extend it to lower your payments.

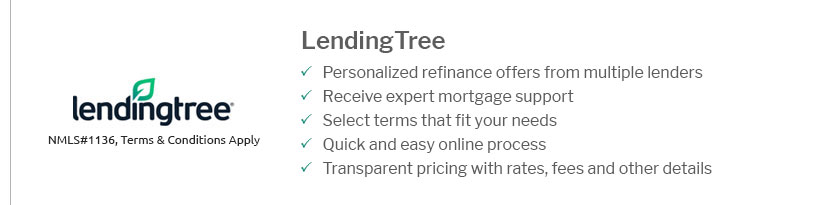

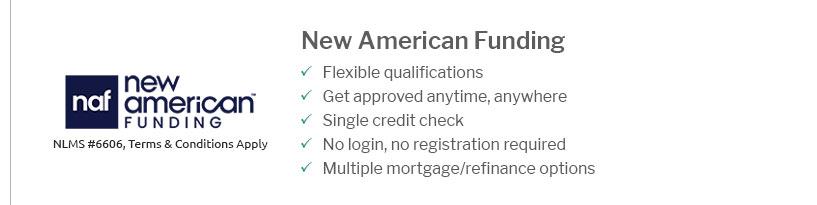

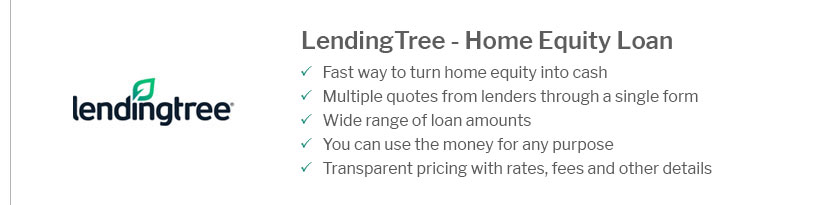

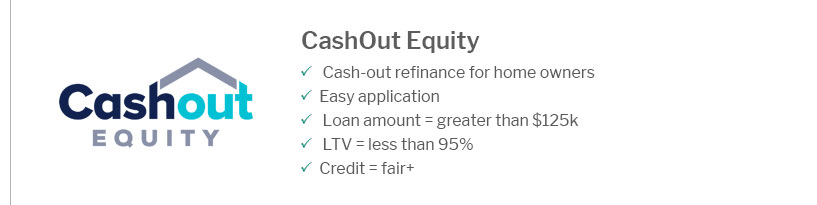

Accessing Home EquityThrough refinancing, you can access the equity in your home, providing funds for significant expenses or investments. Explore va mortgage cash out refinance options if you qualify for VA benefits, as they offer unique advantages. Considerations Before RefinancingCosts InvolvedBe aware of the closing costs and fees associated with refinancing. These expenses can sometimes offset the benefits of lower interest rates. Break-Even PointCalculate how long it will take to recoup the costs of refinancing through the savings generated by lower payments. This is known as the break-even point. Impact on Credit ScoreRefinancing can temporarily affect your credit score due to the credit inquiries and new credit account. Consider this impact if planning to take out additional loans. How to Choose the Right Refinance OptionDifferent refinance options suit different financial situations. Whether you're interested in a traditional refinance or exploring va mortgage cash out refinance rates, it's essential to research and compare the terms and benefits offered by various lenders. FAQs About Refinancing Your HouseWhat is refinancing, and how does it work?Refinancing involves replacing your existing mortgage with a new one, usually to secure better terms. It can lower your interest rate, change your loan duration, or allow you to access home equity. Is refinancing worth the cost?Whether refinancing is worth the cost depends on several factors, including how much you can lower your interest rate, the length of time you plan to stay in your home, and the associated fees. Calculating the break-even point can help determine its value. Can refinancing affect my credit score?Yes, refinancing can temporarily impact your credit score due to the hard inquiries and the new credit account. However, if managed well, it can improve your credit over time by reducing your debt-to-income ratio. https://www.investopedia.com/terms/r/refinance.asp

Refinancing a loan or mortgage is typically done to take advantage of lower interest rates or improve the loan terms, such as the monthly payment or length of ... https://www.bankrate.com/mortgages/when-to-refinance/

Refinancing your mortgage could make sense for several reasons: lowering your interest rate, taking cash out or switching to a fixed-rate loan. https://www.freedommortgage.com/learning-center/articles/why-refinance-at-a-higher-rate

When you need cash to pay for home improvements or repairs that might increase the value of your home, it may make sense to accept a higher rate. Getting money ...

|

|---|